The Power of Digital Marketing for Financial Services

In today’s fast-paced digital world, the financial services industry is constantly evolving to meet the changing needs of consumers. One key aspect that has transformed the way financial institutions connect with their audience is digital marketing.

Reaching a Wider Audience

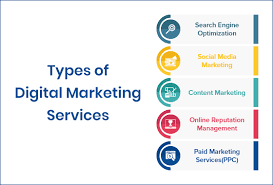

Digital marketing offers financial services companies a powerful platform to reach a wider audience than ever before. Through targeted online advertising, social media campaigns, and search engine optimisation (SEO), firms can connect with potential customers who are actively seeking financial products or services.

Building Trust and Credibility

Establishing trust and credibility is crucial in the financial services sector. Digital marketing provides an opportunity for companies to showcase their expertise, share valuable insights through content marketing, and engage with customers in real-time through social media platforms. By consistently delivering relevant and helpful information, financial firms can build strong relationships with their audience.

Personalised Customer Experience

One of the key advantages of digital marketing for financial services is the ability to create personalised customer experiences. Through data analytics and targeted messaging, companies can tailor their marketing efforts to individual preferences and behaviours, providing a more relevant and engaging experience for customers.

Measurable Results

Unlike traditional marketing methods, digital marketing allows financial services companies to track and measure the effectiveness of their campaigns in real-time. By analysing key performance indicators such as website traffic, conversion rates, and customer engagement metrics, firms can make data-driven decisions to optimise their marketing strategies for better results.

Adapting to Changing Trends

The digital landscape is constantly evolving with new technologies and trends emerging regularly. Financial services companies that embrace digital marketing have the flexibility to adapt quickly to these changes, staying ahead of the competition and meeting the evolving needs of their customers.

In conclusion, digital marketing presents a wealth of opportunities for financial services companies to enhance their brand visibility, engage with customers on a personal level, drive conversions, and ultimately grow their business in today’s competitive market. By leveraging the power of digital channels effectively, financial firms can position themselves as industry leaders and stay relevant in an increasingly digitised world.

9 Essential Digital Marketing Tips for Success in Financial Services

- 1. Understand your target audience and tailor your messaging to their needs and preferences.

- 2. Utilise data analytics to track and analyse the performance of your digital marketing campaigns.

- 3. Stay updated with the latest trends in digital marketing to remain competitive in the financial services industry.

- 4. Create high-quality content that educates and engages your audience about financial products and services.

- 5. Implement SEO strategies to improve the visibility of your financial services website in search engine results.

- 6. Use social media platforms strategically to build brand awareness and connect with potential customers.

- 7. Consider investing in paid advertising such as Google Ads or social media ads to reach a wider audience.

- 8. Build trust with your audience by providing transparent information about your financial services and expertise.

- 9. Monitor feedback from customers and adapt your digital marketing strategies based on their insights.

1. Understand your target audience and tailor your messaging to their needs and preferences.

To succeed in digital marketing for financial services, it is essential to understand your target audience thoroughly and tailor your messaging to meet their specific needs and preferences. By conducting in-depth market research and analysing customer data, financial firms can gain valuable insights into the behaviours, motivations, and pain points of their audience. This information allows companies to create personalised marketing campaigns that resonate with their target customers, ultimately driving engagement, building trust, and fostering long-lasting relationships in the competitive digital landscape.

2. Utilise data analytics to track and analyse the performance of your digital marketing campaigns.

To maximise the effectiveness of your digital marketing efforts in the financial services sector, it is essential to leverage data analytics to monitor and evaluate the performance of your campaigns. By utilising data-driven insights, you can gain a deeper understanding of your target audience’s behaviour, preferences, and engagement levels. This valuable information allows you to make informed decisions, refine your strategies, and optimise your marketing initiatives for better results. Data analytics empowers financial services companies to measure the impact of their digital campaigns accurately and adapt them in real-time to achieve maximum ROI.

3. Stay updated with the latest trends in digital marketing to remain competitive in the financial services industry.

Staying updated with the latest trends in digital marketing is essential for financial services companies to remain competitive in today’s dynamic industry landscape. By keeping abreast of emerging technologies, innovative strategies, and shifting consumer behaviours, firms can adapt their marketing efforts to meet evolving customer expectations and stay ahead of the curve. Embracing new trends allows financial institutions to engage with their audience more effectively, drive conversions, and maintain a strong online presence that resonates with modern consumers. Keeping pace with digital marketing trends is not just a recommendation but a strategic imperative for success in the fast-paced world of financial services.

4. Create high-quality content that educates and engages your audience about financial products and services.

Creating high-quality content that educates and engages your audience about financial products and services is a crucial tip in digital marketing for financial services. By providing informative and valuable content, such as blog posts, articles, videos, and infographics, you can establish your expertise in the industry, build trust with your audience, and drive engagement. Educating your audience not only helps them make informed decisions about financial products but also positions your brand as a reliable source of information, ultimately leading to stronger relationships with customers and increased brand loyalty.

5. Implement SEO strategies to improve the visibility of your financial services website in search engine results.

Implementing SEO strategies is crucial for enhancing the visibility of your financial services website in search engine results. By optimising your website with relevant keywords, meta tags, and high-quality content, you can improve your site’s ranking on search engine results pages. This increased visibility not only drives organic traffic to your website but also helps establish your brand as a trusted authority in the financial services industry. Investing in SEO is a long-term strategy that can yield significant benefits by attracting qualified leads and boosting conversions for your business.

6. Use social media platforms strategically to build brand awareness and connect with potential customers.

Utilising social media platforms strategically is a crucial tip for financial services firms looking to enhance their digital marketing efforts. By leveraging platforms such as Facebook, Twitter, LinkedIn, and Instagram effectively, companies can not only build brand awareness but also connect with potential customers on a more personal level. Engaging with audiences through informative content, interactive posts, and timely responses can help establish trust, credibility, and foster meaningful relationships that drive customer engagement and loyalty in the competitive financial services landscape.

7. Consider investing in paid advertising such as Google Ads or social media ads to reach a wider audience.

When it comes to digital marketing for financial services, one effective tip is to consider investing in paid advertising channels like Google Ads or social media ads. By leveraging these platforms, financial firms can expand their reach and target a wider audience of potential customers who are actively seeking financial products or services. Paid advertising allows companies to strategically place their brand in front of relevant audiences, increasing visibility and driving traffic to their websites or landing pages. This targeted approach can lead to higher conversion rates and ultimately contribute to the growth and success of the business in the competitive digital landscape.

8. Build trust with your audience by providing transparent information about your financial services and expertise.

Building trust with your audience in the financial services industry is paramount. One effective way to achieve this is by offering transparent information about your financial services and expertise. By being open and honest about the products and solutions you provide, as well as showcasing your industry knowledge and experience, you can establish credibility with your audience and demonstrate that you are a trustworthy partner they can rely on for their financial needs. Transparency breeds trust, and in an industry where trust is key, this approach can set you apart from competitors and build long-lasting relationships with your customers.

9. Monitor feedback from customers and adapt your digital marketing strategies based on their insights.

Monitoring feedback from customers is a crucial aspect of digital marketing for financial services. By actively listening to what customers have to say about their experiences, preferences, and needs, companies can gain valuable insights that can inform and shape their marketing strategies. Adapting digital marketing efforts based on customer feedback not only demonstrates a commitment to customer satisfaction but also allows financial firms to tailor their messaging, products, and services to better meet the expectations of their target audience. This customer-centric approach can lead to improved engagement, loyalty, and ultimately, business growth in the competitive landscape of the financial services industry.